DEALS ANALYSIS

Deals activity: South and Central America sees significant decrease in volume; deals down across sectors

Powered by

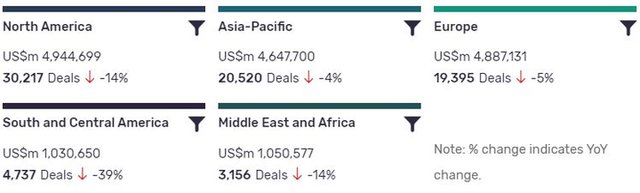

Deals activity by geography

Power industry deals, as captured by GlobalData’s Power Intelligence Centre, are down year-on-year (YoY) across all regions.

North America is leading in terms of deal value, but also recorded a significant decrease in YoY growth in deals volume at -14%. South and Central America, ranking last in terms of deal value, has also suffered the biggest YoY change, with deal volumes at -39%.

The volume of deals recorded by GlobalData also decreased YoY in Middle East and Africa (-14%), Europe (-5%), and Asia-Pacific (-4%).

Deals activity by type

| Deal type | Total deal value (US$m) | Total deal count | YoY change (volume) |

| Asset Transaction | 7250716 | 32200 | -26 |

| Debt Offering | 4140027 | 12978 | 36 |

| Acquisition | 2799280 | 12076 | -2 |

| Equity Offering | 1420804 | 7189 | -1 |

| Partnership | 106515 | 5747 | -48 |

| Venture Financing | 62088 | 4509 | -29 |

| Private Equity | 392389 | 2195 | -8 |

| Merger | 258696 | 355 | -97 |

A breakdown of deals by type and volume shows a general downtrend, with acquisitions down -2% YoY, mergers down -97%, partnerships down -48%, and asset transactions down -26%. Financing deals have seen a similar downturn, with venture financing down -29% YoY and equity offerings down -1%, although debt offerings saw growth of 36%.

Deals activity by sector

The most notable development apparent in GlobalData’s analysis of power industry deals by sector is the decrease of deals across all sectors. Solar PV remained the leading sector by deals volume after several strong years of growth but also saw a decline of almost 500. Hydro saw the lowest decline in its total volume, with a drop of roughly 120.

Note: All numbers as of 04 November 2020. Deals captured by GlobalData cover M&As, strategic alliances, various types of financing and contract service agreements.

For more insight and data, visit GlobalData's Power Intelligence Centre.

Latest deals in brief

Luxcara acquires solar power project from BELECTRIC in Germany

German asset management company Luxcara has announced the acquisition of a 172MW solar farm from BELECTRIC, a solar power plant developer. The acquired facility is claimed to be the largest German photovoltaic project that is not owned by a utility.

RWE acquires Nordex’s 2.7GW development pipeline in Europe for $467m

German energy company RWE Renewables has completed the acquisition of Nordex’s European onshore wind and solar development platform for approximately €400m ($467m). In August, Nordex Group selected RWE as a buyer for its onshore wind and solar projects. Under the deal, RWE has acquired a total 2.7GW development pipeline in France, Spain, Sweden and Poland.

Skyline Renewables acquires 250MW solar project in Texas, US

Skyline Renewables has acquired the 250MW Galloway solar project in Central West Texas from 8minute Solar Energy for an undisclosed sum. Backed by the French private equity investment company Ardian, Skyline Renewables will finance and manage the construction of Galloway solar project. Construction of Galloway solar project is being financed by a consortium of banks led by CIT and will be joined by Rabobank, Commerzbank, DNB Capital and Siemens Financial.

MIRA to acquire Romanian power assets portfolio from ČEZ Group

Global alternative asset management firm Macquarie Infrastructure and Real Assets (MIRA) has announced that a consortium led by Macquarie European Infrastructure Fund 6 agreed to acquire Romanian power assets portfolio from ČEZ Group.

The asset portfolio comprises 86,665km of the regulated electricity distribution network, as well as an electricity and gas supply business with 1.4 million residential and industrial connections across south-west Romania.

Avangrid to acquire US energy holding company PNM Resources

Iberdrola, through its US-based utility company Avangrid, has announced the acquisition of New Mexico’s energy holding company PNM Resources. PNM Resources through its regulated utilities, PNM and TNMP, PNM Resources supplies electricity to homes and businesses in New Mexico and Texas. The deal was approved by the board of directors of Avangrid and the transaction is recommended to PNM shareholders by its board of directors.

Rhizen signs oncology drug development deal with Curon

Swiss biopharma company Rhizen Pharmaceuticals has signed an exclusive licensing agreement with Curon Biopharmaceutical to develop and commercialise Tenalisib for oncology in the Greater China region. Tenalisib, a highly selective dual PI3K delta and gamma inhibitor, is currently in Phase II clinical development for haematological malignancies. The US FDA granted fast track and orphan drug designations for the drug candidate Tenalisib as a treatment for relapsed/refractory peripheral T-cell lymphoma and cutaneous T-cell lymphoma.