Building a digital business case

Digitalization – Improving the ability to adapt and grow

One of the lessons we have learned from the energy transition is that companies must be willing to embrace change. A major shift that seems particularly significant for the energy sector over recent years is that data has become a more important resource for supporting the energy transition, perhaps even the most important one of all as it provides critical insights into making decisions.

Power generators nowadays produce huge data volumes – but only use them to a certain extent. The untapped potential is remarkable. Digital solutions alone won’t unlock that potential, but using digital solutions together with the right engineering partnership is the best way to glean information from data, consolidate it and present useful insights that allow operators to optimize the way their asset is run.

In short: Digitalization is about turning data into value for a business and is one of the key enablers for improving performance, managing risks, reducing costs and delivering flexible operation. Whether digital transformation is lucrative for a company can be evaluated in advance – with a digital business case that examines the current as well as the future situation and provides a solid basis for decisions.

In the following, you will find out what steps you need to take to create a business case and take your asset to the next level.

Creating your vision and mission

All power generators naturally have some common goals. They need to ensure safe operations and adherence to regulations and many are looking to reduce emissions and their carbon footprint. And like any business they want to be successful and financially profitable which can be a moving goal post during the energy transition. But what exactly success means to them and which path leads to their goals is different and individual for each of them. Each power generator and their asset has its own focus areas and sets of priorities in the definition and realization of its vision.

Based on the particular focus of the asset, there are various ways to achieve an objective. In order to carry out the digitalization of a power generator, the inherent vision and mission of the power generator must be defined so that there is clarity regarding the desired goal.

The vision defines the desired goal in the future and is an example for the long-term development of the company, while the mission describes how the company will achieve its long-term vision. Together, they define the energy operator’s role. In many cases the vision and mission are based on regional needs. You as an operator consider your position in your country’s energy transition. You match your strategy with societal benefits and aim to be a responsible generator, e.g. by doing the right thing for the local area and guaranteeing reliable power or by moving away from coal by modernizing your asset towards renewable energy.

D can make a major contribution to achieving these goals and there are countless ways to implement it. If you know what you are working towards, you can choose the path that brings you closer to your goal. So both vision and mission should be defined at the beginning of the digital transformation. This ensures that everyone involved in the process knows which direction they want to take.

Analyzing risks and opportunities

After we understood why a company is doing what it is doing, the second step is to talk about the opportunities and risks that the plant faces – first at market level and later at plant level.

Market level

The position in the market defines the basic requirements for working on a digital business case. To determine the position, we need you to answer several basic questions at the beginning.

- What is your government’s policy on renewables? Assess your country’s energy standards and how you can be part of the strategy.. For instance, if there is a target energy from renewables rate of >10-15% capacity from renewables rate, then flexible operations from older assets will be required in the future.

- What is the attitude towards emissions? Assess restrictions or maybe change your fuel mix or type.

- What other market mechanisms are available or going to be introduced for capacity or security of supply reasons?

Plant level

We can make a powerful snapshot of the opportunities and the risks in consideration of current and future operating scenarios. We review the plant status and analyze the plant on a system by system level looking at the risks and opportunities associated with the equipment. We take the equipment’s history into account as well as other similar installations that we have experienced all over the world. Moreover, we look at the operations and maintenance organization on the site against a benchmark from their best sites. The aim is to evaluate the effectiveness and efficiency of organizational setup, its people, O&M processes, systems and practices of the asset, or portfolio of assets.

Prioritizing your actions – Identifying your priorities

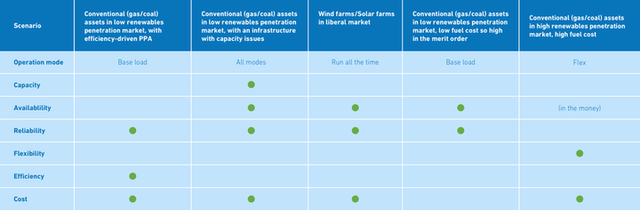

The analysis above will reveal many risks and opportunities. Unfortunately, no business has all the resources to focus on all of them. Hence, there needs to be a way of finding out which ones you should address first. This can be done by prioritizing resources to deliver improvement in some of the main areas of asset:

- Capacity

- Availability

- Reliability

- Flexibility

- Efficiency

- Cost

It is not necessary to try to optimize all of them at once, but rather focus on a select number – based on the vision, mission, risks and opportunities of the market. If you want to operate greener, you enhance the efficiency. If you want to improve maintenance, you optimize the reliability of your plant. If you plan to operate differently, you work on the flexibility.

For example a gas fired plant in a merchant market in the UK at the moment will be focused on providing reliable, flexible operation at minimal cost to the grid so that it can earn money in the balancing market to support grid stability. Conversely, a renewable asset in the UK needs to focus on availability and reliabililty as it is always first in the merit order.

Overview of aspects to optimize in certain markets.

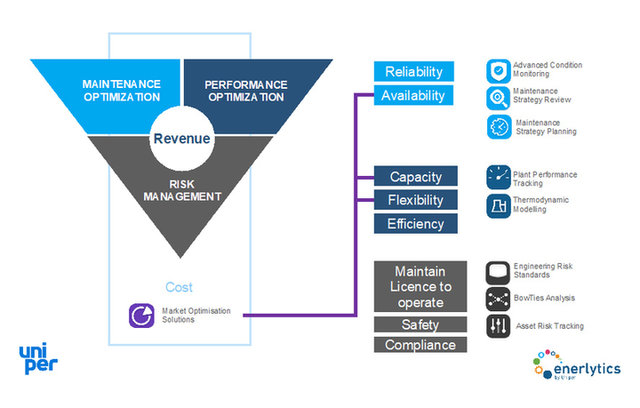

When you choose the right partner with the right digital solution, you are able to optimize all the aspects mentioned above, summarizing them in one single interface that gives you a simple overview of all the information that you need for operations.

Digital solutions help extract benefits at a portfolio level.

Building your business case

Now you have already defined where you want to go based on your vision and mission. You also know the market you are in, what opportunities and risks there are in the portfolio and which areas should be optimized in order to achieve the defined goals. Since it is impossible to make ultimate statements about the future, we develop three different scenarios: A best case scenario, a base case and a worst case.

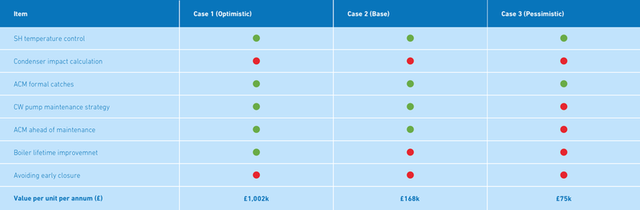

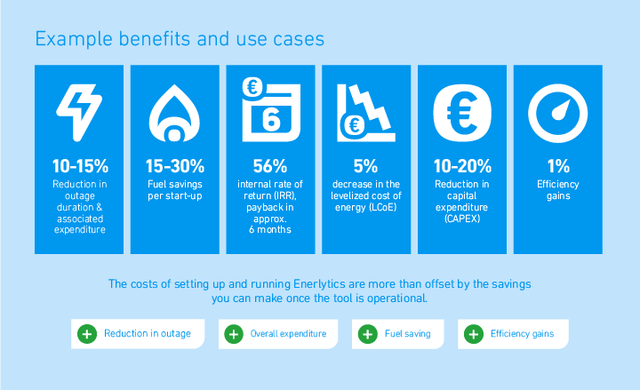

In order to build your business case, you need to gather all the use cases that are relevant to your plant. Each of these use cases is an example of the value earnt or money saved from a particular solution. E.g. stablization of SH temperatures; alteration of CW maintenance strategy or Condenser improvements. It is important to select use cases which are either from a pilot project on your asset or similar assets. At Uniper have a variety of examples that we can share with you, derived from decades of operational data. With a history going back 100 years and a current varied portfolio of 34GW across Northern Europe and Russia, plus clients all around the world we have experience of operating in many different markets. This experience gives invaluable insights for building a credible digital business case.

We employ the use case examples to create an optimistic case, a base case and a pessimistic case, which is then used to generate the potential value per unit per annum.

Example of business cases with value per annum for three different scenarios.

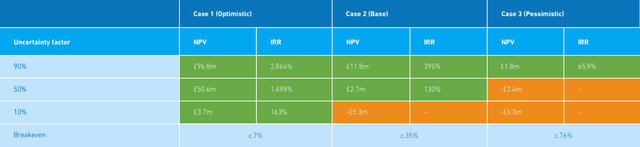

Once you selected your case, you start calculating the NPV and the IRR based on the returns. The case studies provide a value for one unit so can be multiplied by the number of assets. An uncertainty factor is then applied to understand the shape of the “risk to value curve”, which creats the example matrix below. The business case also needs to consider staged rollouts to best ensure value extraction and regard the time period for valuation (e.g. 5 years), inflation (e.g. 2% yoy), depreciation period (e.g. 3 years), value capitalized and discounted cash flow (e.g. Company WACC).

Examples of a digital business case return scenarios.

The above example is a positive digital business case, where the risk of not returning on the investment is low and the upside on over delivery is significantly higher than losses. This is a positive risk to value curve.

Uniper – Your partner in digital transformation

Contact us and learn more about your partnership with Uniper for building your digital business case. Arrange a meeting to discuss your challenges and possible solutions. We would be happy to share the evidence of the savings that going digital with us can deliver.

Playing catch-up in the US

“In Europe, offshore wind has been there for a number of years, but I think in the United States we're a little bit behind that,” said Karustis.

Should it be successful, Halo’s approach could lead to a surge in US onshore wind, which has historically lagged behind other regions in terms of wind installation and production. Since 2016, according to the International Energy Agency, the US has installed just 22.6GW of new onshore wind capacity, compared to 30.7GW in the EU, and 50.3GW in China, struggles that Karustis hopes to address.

Last December, the Chinese Government approved a number of new offshore wind projects, totalling 13GW of production and costing around $13.3bn, as the country continues to invest in utility-scale power. Karustis hopes projects like Halo’s distributed turbine can contribute to a more balanced wind sector in the US, with both large- and small-scale operations expanding renewable power.

“The large-scale wind turbines wouldn't be phased out, it's kind of an ‘all of the above’ thing,” he said. “The large wind farms play a very important role for us in reducing the carbon footprint globally, and hopefully the micro wind market is going to augment that by producing energy where energy is being used. It's a good two-pronged approach.”

This two-pronged approach also includes other renewable power sources, including solar and utility-scale wind; Halo is not trying to replace all clean energy with its turbines, but offer another option for people eager to engage in renewable power, who may have been historically sidelined due to the high costs of building utility-scale facilities or the unsuitable geographical characteristics of the places they live.

“When you look at that market we're very excited because just as megawatt-scale wind is a large market, I think distributed wind can be as big of a market or bigger over time,” said Karustis.

“When you have incentives and improvements in the technology, the costs go down, so you can be more competitive and compete, and that's certainly the case with megawatt-scale wind,” he continued. “Just 15/20 years ago, it wasn't competitive with natural gas [and] coal, but it is now. So those government policies have helped and they've driven the technology improvements, so it's all bundled together.”

contact

information

Uniper Technologies Ltd