Feature

Trump’s tariffs spell trouble for US green hydrogen

The sweeping new round of import tariffs may put the brakes on the US green hydrogen boom – right as it gains steam. Jackie Park investigates.

Of the 8.6mtpa of low-carbon hydrogen capacity announced in the US through 2030, green hydrogen only accounts for 36%. Credit: AI generated / Shutterstock

Over the past few years, the US has emerged as a major player in the global green hydrogen landscape.

Fuelled by robust policy incentives under the Inflation Reduction Act (IRA) and the Bipartisan Infrastructure Law, also known as the Infrastructure Investment and Jobs Act, the US hydrogen pipeline has swelled to over 8.6 million tonnes per annum (mtpa) of production capacity targeted by 2030. Of that, more than a third is made up of green hydrogen projects.

But the journey hasn’t been smooth sailing. Industry has long cited high levelised-production costs and demand uncertainty, which have only been compounded by domestic policy shifts.

In January, the government finalised 45V hydrogen tax credit rules under the IRA, sparking industry backlash for unduly strict guidelines. Another pall hanging over the industry is President Trump’s IRA funding pause, which while not impacting the tax credit, put into jeopardy billions in hydrogen grant funding alongside loans to major hydrogen producers such as Plug Power.

Now, the green hydrogen sector faces an entirely new – and highly disruptive – challenge: tariffs.

President Trump’s newly-announced “Liberation Day” tariffs – a baseline 10% tariff across all imports, with steeper rates for certain countries – guarantees an impact on all sectors but poses a particularly acute challenge to the value chains of emerging clean technologies such as green hydrogen.

According to a new report by Future Power Technology’s parent company, GlobalData, the combination of geographically concentrated supply chains, a small membership of electrolyser manufacturers and highly specialised equipment and material requirements will cause the recent announcements to weigh heavily on the US’s green hydrogen sector.

Renewables blow bleeds into green hydrogen

“The slowdown of green hydrogen development is becoming an inevitable consequence of President Trump’s broader stance on renewable energy,” says Clarice Brambilla, energy transition analyst at GlobalData. Indeed, green hydrogen production is defined by renewable energy sources, using clean electricity to split water (electrolysis) into hydrogen and oxygen through methods such as alkaline electrolysis, proton exchange membrane (PEM) electrolysis and solid oxide electrolysis (SOEC).

The result is a compounding effect: higher material costs, fewer renewable projects and ultimately, a decline in green hydrogen capacity.

Therefore, US green hydrogen projects relying on co-located solar and wind installations are expected to be hit hardest by recent policy shifts, as they will face higher production costs stemming from tariffs on solar and wind components. “The newly imposed 25% tariffs on imported steel and aluminium, combined with a staggering 145% tariff on Chinese imports, will further raise costs for upcoming solar and wind projects, which are essential for producing green hydrogen,” Brambilla explains.

Wind turbine manufacturers will feel the squeeze from the steel tariffs, adding to the turmoil the US wind industry has already faced following Trump’s indefinitely halting the development of offshore wind energy projects across the US, which a coalition of attorney generals filed a lawsuit against on 5 May.

Meanwhile, Trump’s tariff hikes – in addition to previous Biden-era tariffs – on key materials and components such as polysilicon, wafers and solar cells from China and South-East Asian will limit US solar photovoltaic (PV) manufacturers’ access to the pre-eminent market for large-scale and low-cost solar PV manufacturing.

“The result is a compounding effect: higher material costs, fewer renewable projects and ultimately, a decline in green hydrogen capacity,” says Brambilla. “Developers will consequently find it increasingly difficult to justify green hydrogen investments in the US under such political and economic headwinds.”

Electrolyser economics get trickier

The new tariffs are set to disrupt electrolyser supply for US green hydrogen projects, the majority of which is procured from Europe – now subject to the 20% reciprocal tariff on EU goods.

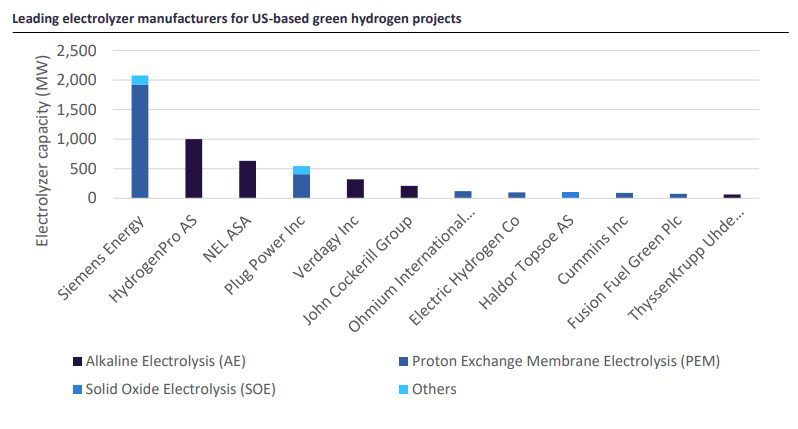

According to GlobalData’s hydrogen database, German energy giant Siemens Energy was the foremost electrolyser manufacturer for US green hydrogen projects, with its PEM product line alone accounting for almost 2GW of capacity across all active and upcoming projects as of 2024. Yet, the company has no manufacturing capacity in the US, making this supply vulnerable to Trump’s tariff.

Source: GlobalData Hydrogen Database

Further down the electrolyser ranking, based on use within active and upcoming US projects, tariffs are expected to have a less severe impact, as European manufacturers such as NEL and John Cockerill have taken steps to establish localised manufacturing in the US.

Even with less repercussion from tariffs, however, the US market outlook for leading European electrolyser manufacturers is unclear. Norway-based HydrogenPro’s planned alkaline electrolyser factory in Texas has been put on hold following uncertainty about the 45V guidelines. Similarly, Denmark-based Haldor Topsoe highlighted the role of the 48C advanced energy project credit, also established under the IRA, in supporting the construction of its SOEC facility in Virginia – tax credits now subject to the disbursement.

Without clarity on federal support, it’s unclear if these facilities will ever break ground. “Trump should prioritise maintaining supportive tax incentives like the 45V hydrogen production tax credit, as they are crucial for encouraging investment in green hydrogen projects,” Brambilla suggests, noting that “45V has garnered bipartisan support, benefiting both red and blue states, particularly where large-scale hydrogen projects are underway”.

Global blowback, domestic boost?

On the flip side, American electrolyser manufacturers like PlugPower, Electric Hydrogen, Ohmium and Verdagy could enjoy a temporary edge. With fewer European competitors in the market, US-based firms may gain market share – at least at home.

But even this silver lining is tinged with risk. First, domestic manufacturers still rely on global supply chains. While critical minerals used in electrolysers such as nickel, platinum and iridium have been exempted from the tariffs, other components haven’t. The 25% tariff on imported steel, for example, hits both wind turbine and electrolyser manufacturers alike. In other words, US firms may avoid direct tariff exposure on the final product but still face cost inflation upstream.

Second, there’s the question of retaliation. If European nations respond with reciprocal tariffs, US electrolyser manufacturers eyeing global expansion may find themselves shut out of overseas markets.

“Protectionist tariffs are fracturing critical supply chains and isolating US manufacturers from global innovation and scale, at a time when collaboration is essential to driving down the levelised cost of renewable energy – the result being a weaker domestic hydrogen market and lost international competitiveness,” Brambilla notes.

“As others double down on hydrogen partnerships, particularly the EU and China, the US may find itself locked out of the very economy it helped kickstart.”

Lastly, the narrowing of supply options may not only raise costs but also lower quality. US green hydrogen developers will likely face a scenario of decreased product range and accessibility across the suite of electrolyser technologies.

This poses a challenge to finding the most compatible technology for different projects when considering parameters such as power source characteristics, hydrogen purity levels and target hydrogen volumes. As choice narrows, developers may be forced to compromise on technology fit, potentially selecting less optimal systems just to keep projects alive.

Trump’s hydrogen ‘favouritism’ and the outlook for US green hydrogen

All this turbulence in the green hydrogen sector comes at a time when blue hydrogen – produced from natural gas with carbon capture and storage (CCS) – already accounts for 64% of the 8.6mtpa of low-carbon hydrogen capacity announced in the US through 2030.

The more obstacles green hydrogen faces, the more tempting the blue route becomes, especially given the US’s abundant domestic gas reserves and relatively mature CCS infrastructure.

“This imbalance is likely to grow in the coming years,” says Brambilla, as Trump’s “favouritism for traditional energy over clean alternatives has clear implications for hydrogen: blue hydrogen relies on natural gas combined with carbon capture, an approach much more aligned with Trump’s energy strategy, while his attitude towards green hydrogen is largely shaped by his broader ideological opposition to renewable energy.”

“His policies will thus further tilt the playing field toward fossil fuel-derived hydrogen and away from renewables-based pathways.”

For green hydrogen developers in the US, Trump’s tariffs mean fewer electrolyser options, longer lead times and higher costs, which could delay project timelines or even kill off feasibility-stage initiatives unable to pass final investment decisions.

Assuming the current policy trajectory continues, a consolidation of the existing green hydrogen pipeline can be expected across the next year. Without swift policy recalibration, America’s green hydrogen dreams risk being caught in the crossfire of a trade war.

“The sweeping ‘Liberation Day’ tariffs may have been politically strategic, but they are economically shortsighted,” Brambilla concludes.

But all hope may not be lost just yet. In a recent shift, Trump hinted that he considers easing tariffs on Chinese imports – a sign he may recognise that his political strategy could backfire on U.S industries such as that of green hydrogen.

“But the bigger question now is: has the damage already been done? While Trump might now see the value of re-engaging with Chinese suppliers, it’s unclear whether Beijing will be willing to play ball after the recent weeks of antagonism,” Brambilla cautions.

“If tariffs aren’t rolled back soon and decisively, the US risks isolating itself from a market it can’t afford to ignore, particularly as other countries continue to deepen partnerships with China in the race for low-carbon technologies.”

Navigate the shifting tariff landscape with real-time data and market-leading analysis.

Request a free demo for GlobalData’s Strategic Intelligence here.