Low-carbon hydrogen is set to occupy a crucial role in the decarbonisation efforts of several energy-intensive industry verticals globally.

Refining and petrochemicals will remain the core hydrogen demand centres while applications such as metallurgy, transportation and power generation will also rise as new end-use avenues. Besides those, the prospects of low-carbon hydrogen in consumer segments are being explored.

In recent years, low-carbon hydrogen capacity has been gaining momentum and is set to grow at a compound annual growth rate (CAGR) of more than 40% between 2024 and 2030.

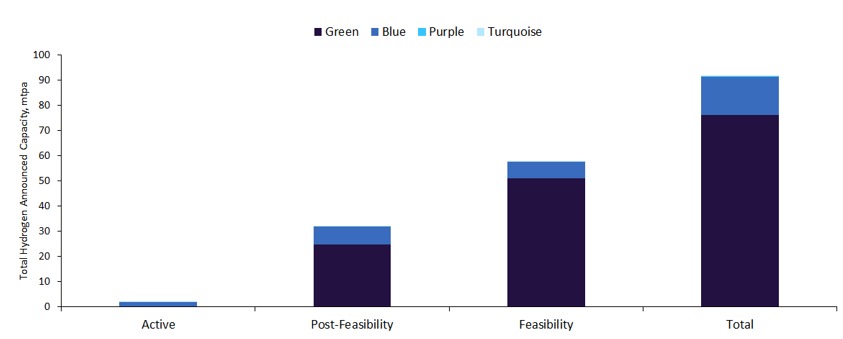

Low-carbon hydrogen, total announced capacity (mtpa), 2030. Credit: GlobalData

On the surface this outlook appears promising. However, their capacity additions of around 13.5 million tonnes per annum (mtpa) might not be enough to support the interim 2030 net-zero goals set by the UN.

Nearly three-fifths of the upcoming 2030 capacity consists of projects in the feasibility stage, of which several may struggle to advance further due to challenges pertaining to infrastructure, financing and demand from end users.

Several major economies including the US and the EU have laid out elaborate plans to incorporate hydrogen within their energy mix as climate change mitigation gains precedence. These plans could help support the development of new low-carbon hydrogen plants in the coming years.

Low-carbon hydrogen, such as blue and green hydrogen, will find prominent demand from the newer hydrogen demand avenues. The use of wind, solar and other renewable sources to produce green hydrogen is expected to grow at a tremendous rate by the close of this decade.

This could complement hydrogen-based power generation plans in the future. Conversely, energy demands from green hydrogen projects would enhance the development of renewable energy projects.

Although recent policy shifts around renewables and decarbonisation in markets like the US have raised concerns about the projected trajectory of the low-carbon hydrogen market, GlobalData analysis finds that while such changes may slow growth, the momentum is expected to remain strong.

Further discussion on the hydrogen theme can be found in leading data and analytics company GlobalData’s new Hydrogen thematic report.