Feature

High promise, high potential: the future of Nigerian renewables

Power generation remains one of the biggest barrier for Nigerian households. Smruthi Nadig investigates how almost half of the country’s power needs could be met by 2030.

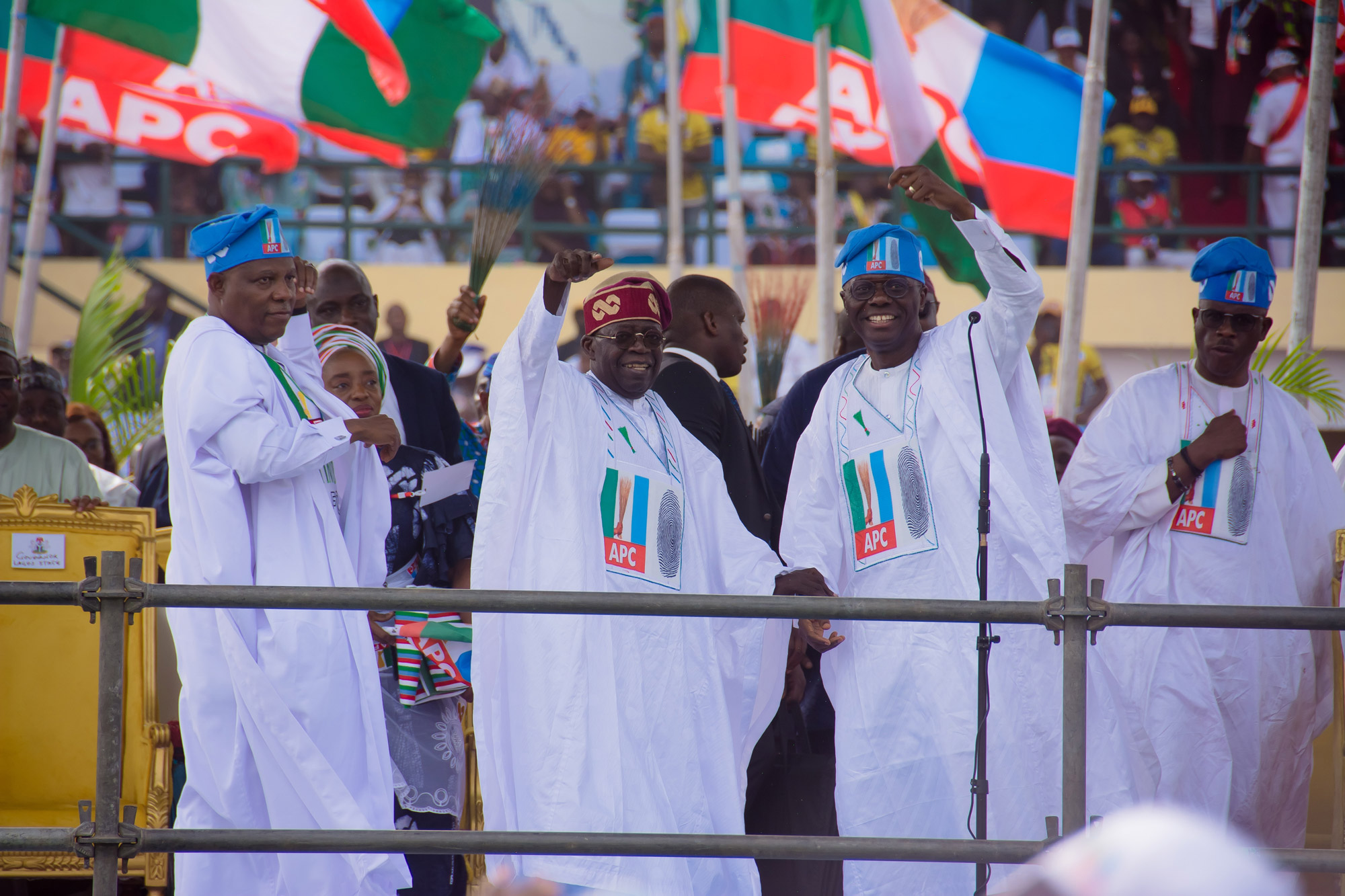

Nigerian President-elect Bola Tinubu and supporters. Credit: Oluwafemi Dawodu/Shutterstock

Nigeria has a growing population with a range of socio-economic issues that need sustainable energy resources to meet climate goals. Due to this, the country has an increasing demand for energy, putting pressure on existing power infrastructure, but also opening the path for further economic development.

Nigeria has an abundance of fossil fuels and the potential for considerable renewable energy production, such as solar, hydropower and wind. While much of this clean energy potential has gone untapped, now could be an ideal opportunity to change its energy mix, and deliver more reliable power to its citizenry.

Francesco La Camera, director of the International Renewables Energy Agency (IRENA), said: “Nigeria can provide sustainable energy for all its citizens in a cost-effective manner by using its abundant, untapped renewables. Nigeria has a unique opportunity to develop a sustainable energy system based on renewables that support socio-economic recovery and development, while addressing climate challenges and accomplishing energy security.”

IRENA’s renewables report shows that renewable energy sources can meet nearly 60% of Nigeria’s energy demand in 2050. This could cut the country’s demand for oil by 65% and natural gas by 40%, and could see renewables account for 47% of total energy demand by 2030, and 57% by 2040, impressive figures for a country without an established history of renewable investment.

Stabilising the grid

According to research, Nigeria’s power generation capacity stood at 7.5GW, with 15.6% of this generated by renewables, as of 2019. Conversely, 74% of the energy consumed in 2019 was produced by generators, and according to the Nigeria Electrification Agency, the country lost an estimated $29bn in economic productivity due to erratic power supply.

Indeed, in 2017, companies spent around $14bn on supplemental energy supply, cutting into their revenues and making Nigeria a less attractive investment destination for foreign companies, which could have long-term economic consequences.

Electrification could play an important role in getting higher renewable energy shares, with electricity production by almost doubling by 2050 to 27% from 2015 levels. The power sector would need to accelerate electricity infrastructure additions to gain access to its renewable energy resources. The low-rated capacity of the system has led to greater reliance on high-priced oil-based power generation.

Electrification could play an important role in getting higher renewable energy shares, with electricity production by almost doubling by 2050 to 27% from 2015 levels.

According to the International Energy Agency, making improvements to the grid could become the optimal solution to provide 60% of people with access to electricity if reliability and supply could improve. It said improved power sector management and governance would help reduce outages and transmission losses.

Dr Adeleke Olorunimbe Mamora, Nigeria’s minister of science, technology and innovation, said: “The highly distributed institutional structure of the energy sector in Nigeria means that coordination of policies will be essential to unlocking integrated energy transition planning and ensuring its success.

"A cross-cutting agency or body tasked with doing so would be helpful in building consensus and developing a coherent plan which would allow for the scaling up of renewable energy to meet the needs across the Nigerian energy sector.”

Clean energy investments

Critically, there is considerable interest in building renewable infrastructure in Nigeria. Solar Nigeria, an $80.6m UK government initiative, was announced in 2014 to build distributed solar energy market in Nigeria. Meanwhile, windspeeds average between 2.1m/s and 8m/s at 10m above sea level, in the country's northern parts; this is easily enough to support wind turbines. The country’s Federal Ministry of Power has also mapped the movement of offshore wind to find wind energy potential over Nigerian waters.

Of course, these are small-scale investments compared to some countries. China spent over $90bn on clean energy research and development in 2022, making it the year's biggest clean energy investor, while the US spent $58.9bn on clean energy, and Japan $17.9bn.

China spent over $90bn on clean energy research and development in 2022, making it the year's biggest clean energy investor.

Yet IRENA’s report emphasises the need for investment in renewables, and Nigeria is beginning this transition. The agency hopes that providing more cost-effective options that lower investment costs will make a larger impact than government policies. “The risk of stranded assets is substantial, especially given the cost, price stability and energy security benefits of renewables in comparison with fossil fuels,” the report reads.

Shell acquired Nigerian renewable energy provider Daystar Power in September 2022 to further build the green energy business. This gives an example of wealthy foreign investment in Nigerian power, bringing together Nigerian energy potential and overseas funding. Daystar Power has announced plans to increase its installed solar capacity to 400MW by 2025.

Jasper Graf von Hardenberg, CEO of Daystar Power, said: “We have seen booming demand for solar energy in the African markets where we operate. That has been reflected in our growth: we are on-track to increase our installed solar capacity by 135% in 2022.”

Power generation and emissions

Nigeria-based news agency Punch reported that over 40% of households in the country own and use generators to meet their electricity demands. “Nigerian households, on average, have electricity in their homes for 15 to 18 hours each day. Of that, 44% (or 6.8 hours) is self-supplied by generators. And this differs by geography, in a state like Taraba, only 19% of households report having electricity,” reads a report by Stears and Sterling published in June 2022.

This transition away from low-efficiency local generators could also improve Nigeria’s carbon footprint. According to the London School of Economics, Nigeria remains a relatively low emitter globally, with carbon dioxide production per capita five times lower than the US and 8.7 times lower than the UK. However, Nigeria stands as the third-highest emitter of greenhouse gases (GHG) in Africa, and future power investments are likely to increase the country’s total carbon footprint.

Nigeria has key performance targets of a 20% to 45% reduction in GHG emissions by 2030. According to IRENA estimates, the total carbon dioxide emissions from the energy sector could increase from 119 million tonnes (mt) in 2015 to 201mt in 2030 and 516mt in 2050.

According to IRENA estimates, the total carbon dioxide emissions from the energy sector could increase from 119mt in 2015 to 201mt in 2030.

According to Nigeria’s newly-elected president, Bola Tinubu, the government has started a new policy through the regulator MAP (meter asset provider), aiming to expand the value chain of the power sector. This could grant Nigeria access to a market for carbon credits with an estimated global value of $261bn, providing employment and entrepreneurship benefits for suppliers, installers and manufacturers.

Though the APC government has implemented 67 off-grid power project under the Rural Electrification Agency, and optimism remains for the future of the MAP project, the country has a long way to go. Power outages remain a big problem in the country but Tinubu’s administration will have to focus more on renewables, instead of exploiting the country’s fossil fuel supplies for power generation.