T

he maturity and importance of cloud computing is growing, with the global cloud computing industry forecasted to be worth $1.2tr by 2026. Cloud computing provides users with an approach to consuming IT that is more flexible, resource-efficient and cost-effective than traditional IT.

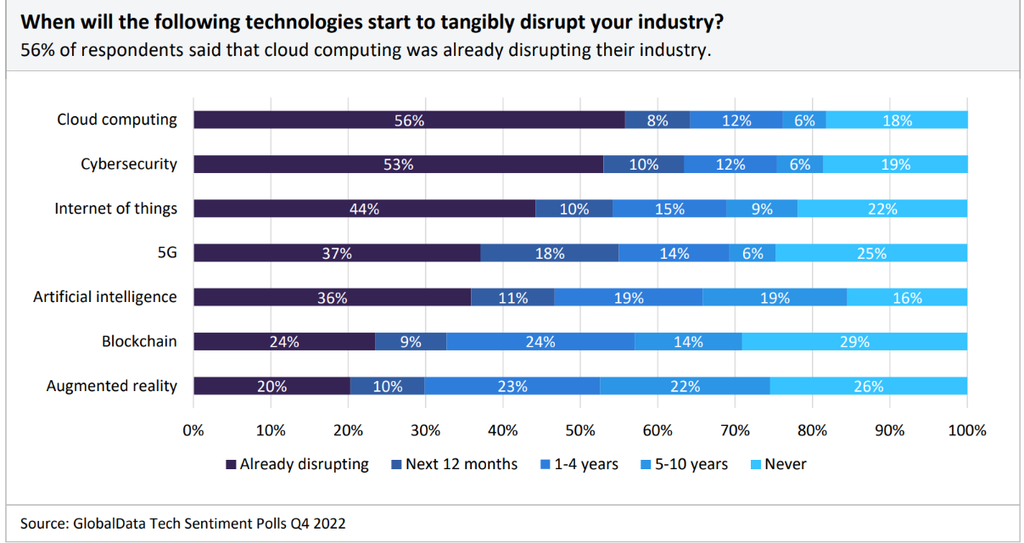

Its importance and widespread use are highlighted in GlobalData’s Tech Sentiment Polls. These polls, designed to understand the current sentiment of the business community towards different technologies, reveal that more than half of respondents believe cloud computing is already disrupting their industry.

The insight from the above poll cuts across all industries, but the importance of cloud computing for the power sector is also apparent. A significant advantage of cloud computing is its scalability and agility. This means that not only can emerging technologies be rolled out across a company (e.g. drones, IoT sensors, etc.), but these technologies can be piloted first at a lower cost and with little to no consequence if their outcomes prove underwhelming.

Furthermore, cloud enables new technologies to be easily scaled up and down as business needs change. With access to real-time data and analytics platforms hosted on the cloud, power companies can often make difficult decisions quickly. Therefore, the scalability and agility of cloud encourages power companies to expand their digitalization efforts and be more innovative.

For example, cloud greatly supports the smart grid integration that transforms the traditional power grid into an IoT network steered by intelligent meters and IoT sensors. European electric utility company E.ON has an ectogrid controlled via its cloud platform, ectocloud. This boosts performance over the entire grid by detecting and reacting to changes in supply, demand and the functioning of on-site machinery in real-time.

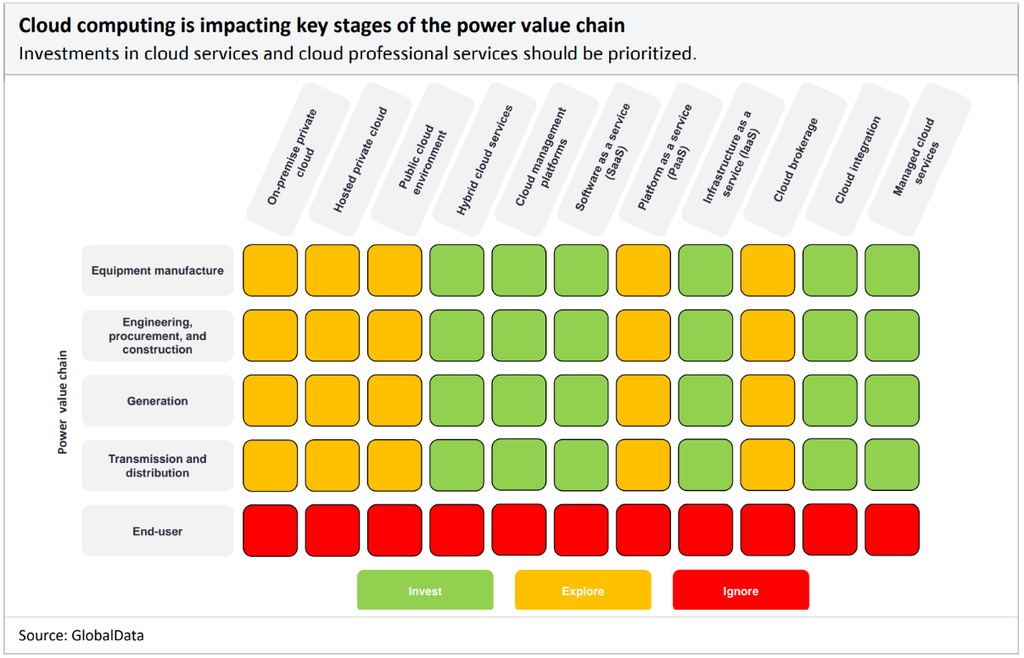

The technology can also automatically prepare for and help recovery from disasters, address high-volume service calls digitally, and constantly monitor the power network for any issues. With the clear importance of investing in cloud computing for power companies, the matrix below details the specific areas in cloud computing where power companies should be focusing their time and resources.

We suggest that power companies invest in technologies shaded in green, explore the prospect of investing in technologies shaded in yellow, and ignore areas shaded in red.

Enterprise cloud spending falls into three main categories: cloud infrastructure, cloud services and cloud professional services. The graphic above breaks down these segments into specific parts, and here we will provide the rationale for some of the illustrated suggestions.

For example, the rationale behind power companies investing in hybrid cloud services is to access all the benefits of the public cloud but from behind an enterprise firewall. Furthermore, it can often be more cost-effective for companies to own and manage the IT infrastructure for baseline activity, including specific large, stable and well-understood workloads.

It is advisable to use public cloud for sudden peaks and troughs in IT needs or when experimenting with new services, applications and technologies. Hybrid cloud services can also facilitate this integration between private and public cloud environments – easing workload migrations between both cloud environments.

For power companies, this either provides an interim solution as all data and applications are migrated to the public cloud or enables the integration of a mixed cloud environment. While many power companies have moved their mission-critical work to the public cloud, some power companies may choose to retain their private on-premise or hosted environments for data compliance or cost reasons.

Therefore, power companies should invest in hybrid cloud services while exploring their options to find what cloud environments best suit their needs. This connects to the suggestion in the matrix above to invest in cloud integration and managed cloud services. These professional cloud services help power companies fully understand their cloud computing needs.

Power companies can harness the knowledge of cloud experts through these professional services to track their cloud usage, adopt and migrate to new cloud environments, or for any post-deployment support. Therefore, any adoption of cloud computing by power companies can run smoothly regardless of the cloud-literacy levels of their workforce.

Out of the cloud professional services, only cloud brokerage is highlighted in amber as a prospect that power companies should explore. This is because the need for cloud brokerage for many power companies still in the process of fully adopting cloud is not immediate.

Cloud brokerage negotiates relationships between cloud providers and cloud consumers and will be necessary as power companies increasingly adopt multi-cloud and complex cloud environments that they cannot manage alone.

GlobalData, the leading provider of industry intelligence, provided the underlying data, research, and analysis used to produce this article..

GlobalData’s Thematic Intelligence uses proprietary data, research, and analysis to provide a forward-looking perspective on the key themes that will shape the future of the world’s largest industries and the organisations within them.