The briefing on coal power: trends across the world

GLOBALLY, COAL POWER IS THE SECOND HIGHEST VALUE CATEGORY BEHIND NUCLEAR POWER, BASED ON cONSTRUCTION INTELLIGENCE CENTRE (CIC) TRACKED PROJECTS, WITH A VALUE OF $907BN.

However, out of the top 50 global power generation projects by value, only two are coal projects: the 6,600MW Bijie coal-fired power plant in China, at a total cost of $15.695bn, followed closely by the Erkovetskaya thermal power plant in Russia, with a capacity of 8,000MW at a cost of $15bn.

Europe

In Europe, government policy decisions have affected investment in power, such as the UK’s decision to have non-coal power generation by 2025.

Coal power stations across the country are scheduled to close by 2025, so there is a move to convert existing coal power plants to biomass and natural gas. This is well advanced, with the UK’s largest power station, Drax, being converted to biomass power generation with a future facility for battery storage on site and natural gas being part of the fuel mix.

Coal power plants are still a major part of the energy strategy in Russia and Poland, together with nuclear power.

In Europe, coal-fired projects account for $63.5bn, in third place behind nuclear and wind, with $358.1bn and $277.6bn, respectively.

Europe

In Europe, government policy decisions have affected investment in power, such as the UK’s decision to have non-coal power generation by 2025.

Coal power stations across the country are scheduled to close by 2025, so there is a move to convert existing coal power plants to biomass and natural gas. This is well advanced, with the UK’s largest power station, Drax, being converted to biomass power generation with a future facility for battery storage on site and natural gas being part of the fuel mix.

Coal power plants are still a major part of the energy strategy in Russia and Poland, together with nuclear power.

In Europe, coal-fired projects account for $63.5bn, in third place behind nuclear and wind, with $358.1bn and $277.6bn, respectively.

Asia-Pacific

Coal is the dominant fuel for projects in Asia-Pacific, with a value of $705.4bn, followed by hydroelectric plants with $479.7bn.

India accounts for the highest level of power generation in the region, with 389.5GW, with coal supplying the most power in Asia-Pacific at a total of 585.9GW.

China, however, is phasing out planned new coal power plants due to overcapacity, the rise of renewable sources and falling demand. The country is attempting to become less dependent on fossil fuels, which powered the growth in industrial production and the country’s urban expansion over the last two decades.

The Five Year Plan, produced in November 2016, set out a strategy for a reduction in coal in energy production from 64% in 2015 to 58% by 2020. The need to reduce air pollution which blights its major cities has contributed to the strategy for more sustainable power sources.

Asia-Pacific

Coal is the dominant fuel for projects in Asia-Pacific, with a value of $705.4bn, followed by hydroelectric plants with $479.7bn.

India accounts for the highest level of power generation in the region, with 389.5GW, with coal supplying the most power in Asia-Pacific at a total of 585.9GW.

China, however, is phasing out planned new coal power plants due to overcapacity, the rise of renewable sources and falling demand. The country is attempting to become less dependent on fossil fuels, which powered the growth in industrial production and the country’s urban expansion over the last two decades.

The Five Year Plan, produced in November 2016, set out a strategy for a reduction in coal in energy production from 64% in 2015 to 58% by 2020. The need to reduce air pollution which blights its major cities has contributed to the strategy for more sustainable power sources.

The Americas

According to the US Energy Information Administration, coal provided 30% of electricity generation, behind natural gas with 34%, and ahead of nuclear with 20%.

Brazil, the major economy of Latin America, leads in the sectors of coal and hydroelectric.

The Americas

According to the US Energy Information Administration, coal provided 30% of electricity generation, behind natural gas with 34%, and ahead of nuclear with 20%.

Brazil, the major economy of Latin America, leads in the sectors of coal and hydroelectric.

Middle East and Africa

Africa has much lower energy consumption than the Middle East with 440.1Mtoe, with carbon based fuels having the highest level of usage; coal is responsible for 95.9Mtoe, behind oil and gas, with 184.4Mtoe and 124.3Mtoe respectively.

The region has potential for the development of renewable sources of power.

Middle East and Africa

Africa has much lower energy consumption than the Middle East with 440.1Mtoe, with carbon based fuels having the highest level of usage; coal is responsible for 95.9Mtoe, behind oil and gas, with 184.4Mtoe and 124.3Mtoe respectively.

The region has potential for the development of renewable sources of power.

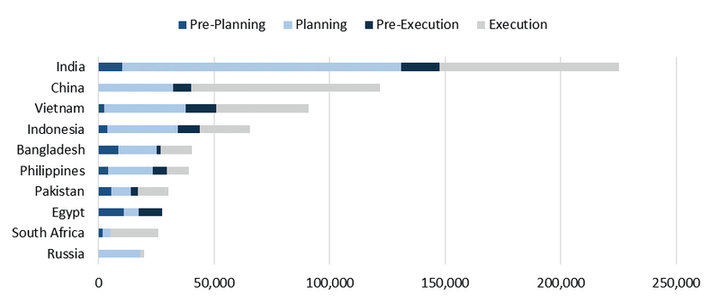

Coal power construction projects

In terms of the value of coal power generation construction projects, India leads the way with over $200bn in construction projects from pre-planning through to execution.

China has more than $100bn of coal power projects in development, while Vietnam and Indonesia both have more than $50bn worth of construction projects.

The top 10 coal power generation construction projects by value is completed by Bangladesh, the Philippines, Pakistan, Egypt, South Africa and Russia.

Coal power generation construction project pipeline, value ($m) by stage: top 10 countries. Source: Timetric

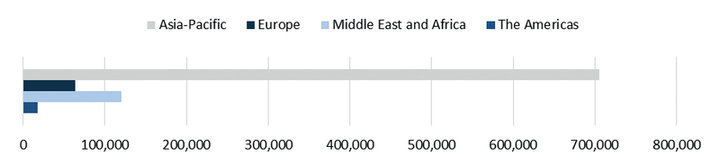

Asia-Pacific leads the way by a considerable margin in terms of the value of coal power generation construction projects, with over $700bn worth of coal projects under construction.

The Middle East and Africa region has over $100bn in coal power generation projects under construction, followed by Europe and the Americas.

Coal power generation construction project pipeline, value ($m) by region. Source: Timetric

Cover image credit: photocosmos1 / Shutterstock.com