Indonesia to speed up geothermal development to solve energy issues

Geothermal power is expected to help Indonesia overcome risks associated with its dependence on fossil fuel imports.

One of GlobalData’s latest reports, ‘Indonesia Power Market Outlook to 2035, Update 2022 – Market Trends, Regulations, and Competitive Landscape’, discusses the power market structure of Indonesia and provides historical and forecast numbers for capacity, generation and consumption up to 2035. Detailed analysis of the country’s power market regulatory structure, competitive landscape and a list of major power plants are provided.

With an estimated 24GW in geothermal reserves, which account for 40% of the world’s geothermal resources, Indonesia is set to accelerate geothermal power development to solve its energy issues.

Indonesia has identified more than 300 sites across islands, including Sumatra, Java, Nusa Tenggara, Sulawesi and Maluku, for geothermal power development. The country has created a fund of around $275m (IDR3.7tn) for the development of geothermal technology. Managed by PT Sarana Multi Infrastruktur, the fund will be primarily used for lending activities, equity participation, and/or providing data and geothermal information.

Indonesia updated its laws on geothermal activities in 2014. The revised regulation no longer considers geothermal under “mining activities”, as mining activities are currently prohibited in high conservation value forest areas. The regulation also introduced a mandatory production bonus payable to the local government in which the geothermal field is located, and auctions were introduced for geothermal working areas (WKP) to encourage industry participation.

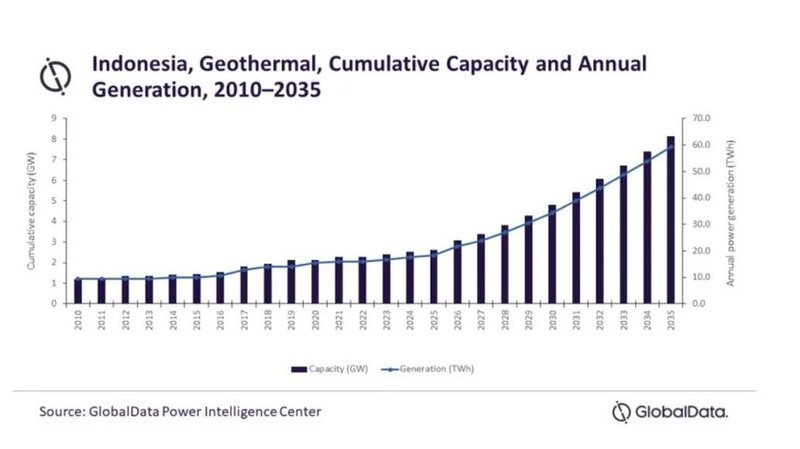

Indonesia has made geothermal power development one of its key priorities and has set a target of achieving 9.3GW of geothermal cumulative capacity by 2035, in order to solve several energy issues and achieve its climate goals. Given the current trend, the country is expected to achieve 8.1GW by 2035.

However, the target may still be achievable if the government succeeds in conducting WKP auctions without delays, provides incentives to overcome the upfront costs in the exploration stage and rallies more foreign private investments.

Geothermal power is also expected to help Indonesia overcome risks associated with its dependence on fossil fuel imports and reduce the country’s economic burden resulting from fossil fuel subsidies. In 2021, around $5.5m was spent on fossil fuel subsidies, and it is estimated that it would burden the country’s economy by around $5.1m in 2022.

Geothermal holds the key to achieving the country’s target of achieving 23% of its energy requirements from renewables and cutting its carbon emissions to net-zero by 2060. The government also hopes to achieve a 100% electrification rate in the country, and geothermal is considered as a reliable source to reach it.

Indonesia’s GDP increased from $755.1bn in 2010 to $1,223.1bn in 2021, at a combined annual growth of 4.5%. After the recommencement of regular industrial and trade activities, the GDP grew by 3.7% in 2021 from 2020. Prior to this, Indonesia was already facing challenges, such as growing political tensions, the trade war between Indonesia’s two largest trading partners, China and the US and the Rupiah’s prolonged depreciation.

// Main image: Geothermal power plant in Indonesia. Credit: Harinnita Detta via Shutterstock

Comment