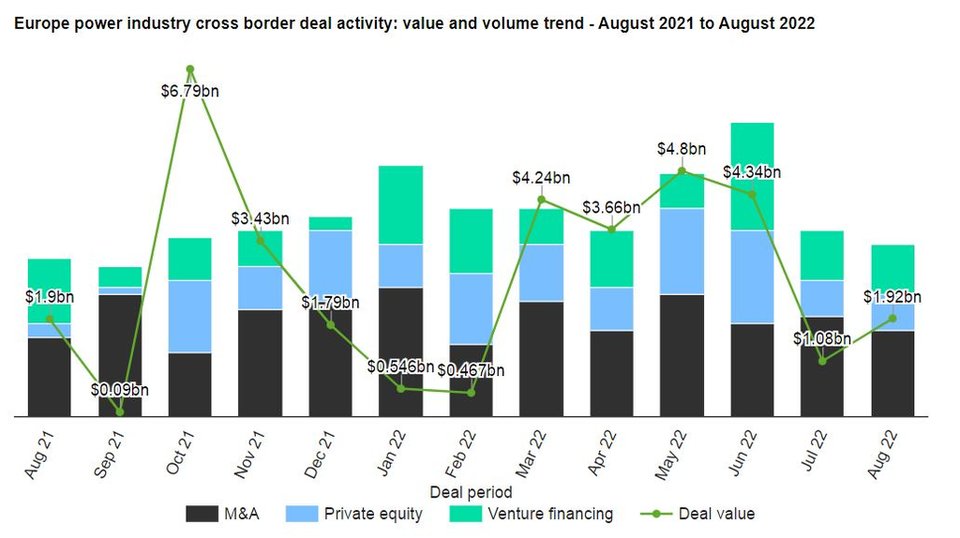

Europe’s power industry saw a drop of 17.24% in cross border deal activity during August 2022, when compared with the last 12-month average, led by RH International’s $1bn private equity acquisition of Nexif Energy Holdings and NXF Holdings 2, according to GlobalData’s deals database.

A total of 24 power industry cross border deals worth $1.9bn were announced for the region in August 2022, against the 12-month average of 29 deals.

Mergers and acquisitions saw the most activity, ahead of venture financing with seven deals, followed by private equity deals with five transactions. Venture financing and private equity deals comprised 29.2% and 20.8% shares, respectively, of the overall cross border deal activity for the month.

In terms of value of cross border deals, M&A was the leading category in Europe’s power industry with $1.5bn, while private equity and venture financing deals totalled $324.8m and $91.26m, respectively.

Top deals in August 2022

The top five power cross border deals accounted for 98.1% of the overall value during August 2022. The combined value of the top five power cross border deals stood at $1.88bn, against the overall value of $1.9bn recorded for the month.

The top five power industry cross border deals of August 2022 tracked by GlobalData were:

- RH International’s $1bn acquisition deal with Nexif Energy Holdings and NXF Holdings 2

- The $490m acquisition of 50% stake in Kalyon Enerji Yatirimlari by International Holding

- Keppel and Keppel Infrastructure Fund Management’s $324.8m private equity deal for 50% stake in Borkum Riffgrund 2

- The $36.89m venture financing of Blue World Technologies by Breakthrough Energy Ventures, Deutz and Vaekstfonden

- EIT InnoEnergy, Enfuro Ventures, Equinor Energy Ventures, Invest-NL, Koninklijke Vopak and Somerset Capital Partners’s $29.91m venture financing deal with Elestor