Green growth: how solar PV and wind power continue to grow in the US

Renewable power held a 19% share of the US’s total power capacity in 2020, and this share is expected to increase significantly to 48.4% by 2030.

One of GlobalData’s latest reports, ‘United States Power Market Outlook to 2030, Update 2021 – Market Trends, Regulations, and Competitive Landscape’ discusses the power market structure of the US and provides historical and forecast numbers for capacity, generation and consumption up to 2030.

The report also gives a snapshot of the power sector in the country on broad parameters of macroeconomics, supply security, generation infrastructure, transmission and distribution infrastructure, electricity import and export scenario, degree of competition, regulatory scenario, and future potential. An analysis of the deals in the country’s power sector is also included in the report.

A significant share

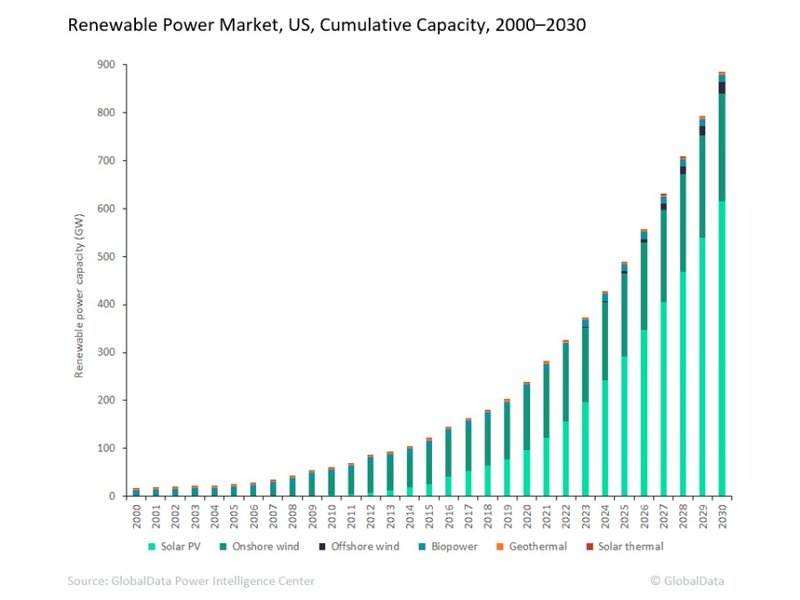

Renewable power held a 19% share of the US’s total power capacity in 2020, and this share is expected to increase significantly to 48.4% by 2030. Favourable policies introduced by the US Government will continue to drive the country’s renewable sector, particularly solar photovoltaics (PV) and wind power. Installed renewable capacity, excluding hydropower, increased from 16.5GW in 2000 to 239.2GW in 2020, growing at a compound annual growth rate (CAGR) of 14.3%.

By 2030, the cumulative renewable capacity is expected to rise to 884.6GW, growing at a CAGR of 14% from 2020 to 2030. Despite increase in prices of renewable equipment in 2021, such as solar modules, the US renewable sector will show strong growth during the 2021 to 2030. This is attributed to a short-term increase in equipment prices due to supply chain disruptions caused by the Covid-19 pandemic.

The US will continue to add significant renewable capacity additions during the forecast period to meet its target of reaching 80% clean energy by 2030. In November 2021, President Biden signed a $1tr Infrastructure Bill, within which $73bn is designated to renewables. This includes not just renewable capacity building, but also strengthening the country’s power grid and laying new high voltage transmission lines, both of which will be key to driving solar and wind power capacity additions.

Supportive regulation and long-term challenges

The expansion of renewable power capacity during the 2000 to 2020 period has been possible due to the introduction of federal schemes, such as production tax credits, investment tax credits and manufacturing tax credits. These have massively aided renewable installations by bringing down the cost of renewable power generation and making it at par with power generated from conventional sources.

Over the last few years, the cost of solar PV and wind power installations has declined sharply. Since 2010, the cost of utility-scale solar PV projects decreased by around 82% while onshore wind installations decreased by around 39%. This has supported the rapid expansion of the renewable market. Yet the price of solar equipment has risen due to an increase in raw material prices and supply shortages, which may slightly delay the financing of some solar projects that are already in the pipeline.

A key challenge remains the ongoing impacts of the Covid-19 pandemic. The US was one of the worst hit countries in the world by the pandemic in 2020, as the electricity consumption in the country declined by 2.5% in 2020 as compared to 2019. Power plants that were under construction faced delays due to unavailability of components due to supply chain disruptions and unavailability of labour due to travel restrictions.

According to the US Energy Information Administration, 61 power projects, having a total capacity of 2.4GWm which were under construction during March and April 2020 were delayed because of the Covid-19 pandemic. Among renewable power technologies, solar PV and wind power projects were the most badly affected due to the pandemic. In March and April 2020, 53 solar PV projects, having a total capacity of 1.3GW, and wind power projects, having a total capacity of 1.2GW, were delayed due to the Covid-19 pandemic.

Moreover, several states suspended renewable energy auctions due to the pandemic. For instance, New York State Energy Research and Development Authority had issued a new offshore wind solicitation for 1GW and up to 2.5GW in April 2020, but this was suspended due to the Covid-19 pandemic. In July 2020, the authority relaunched the tender for 2.5GW of offshore wind capacity, with a submission deadline in October 2020.

To ease the financial burden on consumers during the pandemic, more than 1,000 utilities in the country announced disconnection moratoria and implemented flexible payment plans. Duke Energy, American Electric Power, Dominion Power and Southern California Edison were among the major utilities that voluntarily suspended disconnections.

Comment