Deals in brief

Powered by

Power industry M&A deals in June 2020 total $4.58bn globally

Total power industry M&A deals in June 2020 worth $4.58bn were announced globally, according to GlobalData’s deals database.

The value marked a decrease of 3.3% over the previous month and a drop of 43.9% when compared with the last 12-month average, which stood at $8.16bn.

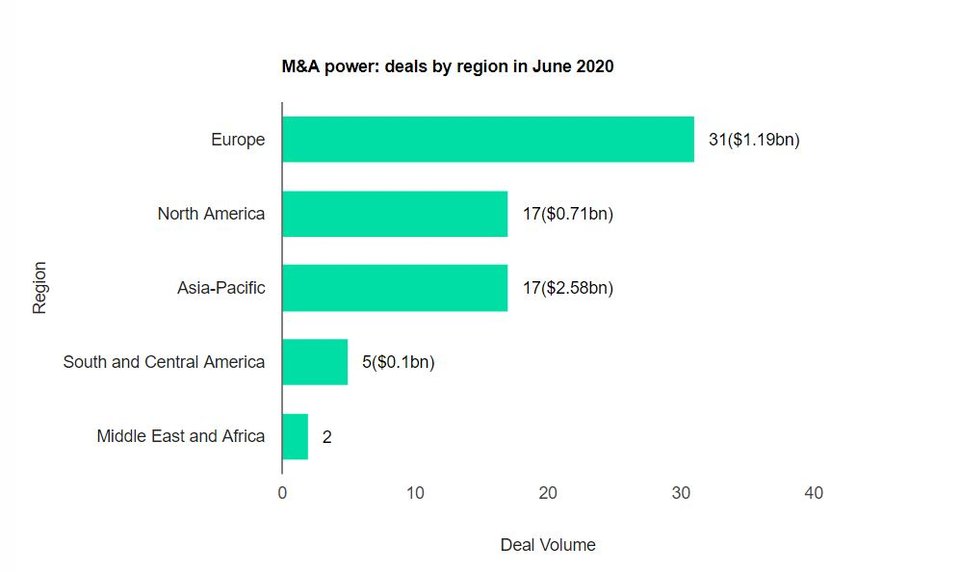

Comparing deals value in different regions of the globe, Asia-Pacific held the top position, with total announced deals in the period worth $2.58bn. At the country level, China topped the list in terms of deal value at $2.11bn.

In terms of volumes, Europe emerged as the top region for power industry M&A deals globally, followed by North America and then Asia-Pacific.

The top country in terms of M&A deals activity in June 2020 was the US with 15 deals, followed by China with eight and the UK with six.

As of the end of June 2020, power M&A deals worth $36.46bn were announced globally, marking a decrease of 9.7% year on year.

Power industry M&A deals in June 2020: Top deals

The top five power industry M&A deals accounted for 69.7% of the overall value during June 2020.

The combined value of the top five power M&A deals stood at $3.19bn, against the overall value of $4.58bn recorded for the month.

The top five power industry deals of June 2020 tracked by GlobalData were:

1) The merger of Fujian Huadian Furui Energy Development and Huadian Fuxin Energy for $1.07bn

2) The $883.6m acquisition of Taicang GCL Waste Incineration Power Generation by Taicang City Investment Environmental Protection Construction Investment

3) Diamond Transmission Partners Walney Extension’s $555.6m asset transaction with Orsted, PFA Holding and PKA

4) The $379.5m acquisition of National Electric Vehicle Sweden by Evergrande Health Industry Group

5) The merger of Middle Tennessee Electric Membership and Murfreesboro Electric Department for $302m

US power industry sees a drop of 43.2% in deal activity in June 2020

The US power industry saw a drop of 43.2% in overall deal activity during June 2020, when compared with the last 12-month average, according to GlobalData’s deals database.

A total of 25 deals worth $791.2m were announced in June 2020, compared to the 12-month average of 44 deals. M&A was the leading category in the month in terms of volume with 15 deals which accounted for 60% of all deals.

Power industry private equity deals in Q2 2020 total $516.38m globally

Total power industry private equity deals in Q2 2020 worth $516.38m were announced globally, according to GlobalData’s deals database.

The value marked a decrease of 93.9% over the previous quarter and a drop of 92.5% when compared with the last four-quarter average, which stood at $6.89bn.

Comparing deals value in different regions of the globe, Middle East and Africa held the top position, with total announced deals in the period worth $235m. At the country level, Israel topped the list in terms of deal value at $225m.

NRG Energy agrees to acquire Centrica’s Direct Energy for $3.625bn

NRG Energy has signed an agreement with UK supplier Centrica to acquire its North American subsidiary Direct Energy for $3.625bn in an all-cash transaction.

The acquisition will double NRG Energy’s customer base across the US and Canadian provinces to more than six million. With this acquisition, NRG aims to diversify its business and enter into states and locales where it does not currently operate.

Brazil’s Eneva offers $1.4bn to acquire stake in AES Tiete

Brazilian power generation company Eneva has reportedly submitted an offer of $1.44bn (BRL7.5bn) to acquire a controlling stake in AES Tiete Energia.

Reuters reported that the proposal was presented to BNDES Participacoes, a holding company for Brazilian state bank BNDES.

Brookfield Renewable to acquire 1.2GW solar project in Brazil

Brookfield Renewable Partners and its institutional partners have signed an agreement to acquire a 1.2GW advanced solar development project in Brazil.

Inflation-linked power purchase agreements currently cover 75% of the energy the project. Brookfield Renewable has said it plans to contract the remaining 25% of power generation before beginning the construction works. At this time, the company plans to finish construction in early 2023.