Middle East renewables surge as energy transition accelerates

Renewable energy project contract awards in 2021 have eclipsed deals for conventional power plant projects as the region’s energy diversification agenda gathers pace, according to a new research report from MEED Insight.

Cumulatively, we are witnessing a democratisation and decentralisation of energy data and decision-making that will result in more agile, adaptable, and ‘smart’ energy networks, with more proactive and even predictive customer service and grid management.

These are just some of the recent permanent shifts in energy grid management spurred by Covid-19 restrictions and how they are contributing to the modernisation and digital transformation of the energy industry.

Renewables on the rise

The outlook for renewable energy project opportunities in the MENA region is bright.

Some $104bn of renewable energy projects are planned, of which about $21.5bn are at the contract tendering stage and are likely to lead to contract awards in 2021 and 2022.

Of the remaining $82.4bn of planned projects, only about $4.1bn are at an advanced stage of design, with the vast majority, some $78.3bn of projects, still under study. Many of these may not go ahead or could change substantially in scope.

In Algeria, for example, the country’s $42.1bn of planned renewables projects is the region’s biggest pipeline, but some $41.9bn are still under study and may not happen.

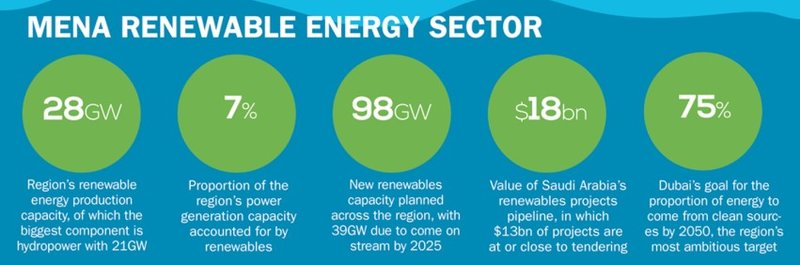

Opportunities abound, however – particularly in Saudi Arabia. According to the ‘Middle East Energy Transition’ report, Saudi’s $18bn renewables projects pipeline offers the best prospects, with some $13bn of renewable energy projects at or close to the tendering stage.

The UAE, which far outstrips Saudi Arabia in terms of installed renewable capacity, has only $370m of renewables projects at the bidding stage.

Credit: MEED

Green hydrogen

The new report identifies hydrogen fuel as an important emerging element in the Middle East’s energy landscape.

The use of hydrogen fuel in electricity generation emits only water vapour and no CO2. Moreover, hydrogen can help decarbonise traditional gas-fired power plants.

The hype surrounding hydrogen, and in particular green hydrogen, has become increasingly hard to ignore as it dominates industry discussions of oil and gas, renewable energy, mining, and climate change. The opportunity to pivot to green hydrogen is particularly strong in the MENA region.

An estimated $42bn of green hydrogen-related projects are being planned across the MENA region – and project announcements have become increasingly frequent over recent years.

Energy transition

Energy transition is now among the highest policy priorities for the Middle East’s oil producers, which have been hard hit by low oil prices since 2015 – a knock that may be exacerbated by the decline in oil demand growth that is predicted by 2040.

In November, the next instalment of the Climate Change Summit (COP26) takes place in Scotland. COP26 will see political and business leaders come together in Glasgow with scientists and activists to discuss the next iteration of the International Climate Change Agreement, and Middle East governments will play a prominent role in discussions.

The event coincides with the Dubai Expo 2020, which has future energy and future mobility as its themes, and which signals the UAE’s intention, along with Qatar and Saudi Arabia, to be a leading player in the future of global energy.

The shift away from fossil fuels is also one of the biggest challenges facing the region.

Cutting CO₂ emissions to net zero, diversifying energy sources away from oil and gas, and reducing consumption to preserve resources requires transformation in all areas of life. At the same time, governments must ensure adequate power and water to meet the needs of growing populations and expanding economies.

Energy demand

Undimmed by the impact of Covid-19, electricity demand is rising by about 5% per year across the MENA region, and with a shortage of gas supplies and the need to decarbonise, expanding renewables capacity is at the top of the region’s energy agenda. There is plenty of room for growth.

With about 28GW of renewable energy production capacity installed across the region, of which the biggest component is hydropower with 21GW, renewables represent only 7% of the region’s power generation capacity.

But, boosted by falling technology costs, most countries are planning and procuring solar and wind projects. And the world’s biggest and cheapest solar projects are now found in Saudi Arabia, Abu Dhabi, and Dubai.

Across the region, governments have set ambitious clean energy targets, with Dubai the most aggressive, aiming for 75% of its energy to come from clean sources by 2050. About 98GW of new renewables capacity is planned across the region, with 39GW due to come on stream by 2025.

One of the region’s objectives is to be a hub for the development of clean technologies. And, the desire for a ‘green’ recovery from the Covid-19 pandemic has provided impetus for a wave of ventures and projects to produce hydrogen fuel in the Middle East.

In particular, tapping the region’s abundant supply of low-cost solar energy to sustainably produce ‘green’ hydrogen from water is generating huge interest from governments and investors.

Green hydrogen is in a similar place to the one held by solar energy a decade ago. As with solar in 2011, hydrogen fuel in 2021 is expensive to produce compared to fossil fuels, and there is only a limited market for the fuel.

But tumbling costs and enabling regulations have reduced the risk of investing in renewables. It is a trend that will support the region’s energy diversification as new technology emerges, making clean fuels commercially viable.

Market Insight from